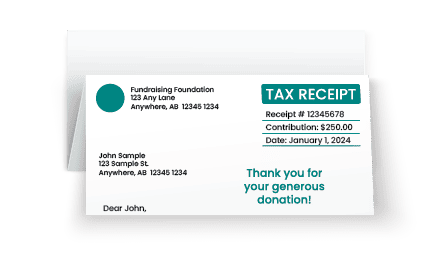

The Power of Saying “Thank You” with Your Tax Receipt

One of the most overlooked elements in fundraising is the way tax receipts are issued. While they serve an essential financial purpose, they also present an opportunity to strengthen donor relationships. Instead of mailing tax receipts separately, integrating them with thank-you notes and fundraising materials can offer significant advantages. For more ideas on optimizing direct mail strategies for non-profits, check out our blog on Innovative DM Strategies for Non-Profits.

1. Cost Savings: Optimize Postage and Handling

Non-profits operate on tight budgets, and every dollar saved on administrative costs can be redirected toward mission-driven efforts. By mailing tax receipts alongside thank-you letters and fundraising materials, organizations can:

- Take advantage of Canada Post’s reclassification, which allows tax receipts with thank-you notes (soliciting future donations) to be sent under the Personalized Mail category, cutting postal rates by nearly 50% compared to previous Lettermail rates.

- Streamline handling and processing, reducing operational expenses.

- Reduce postage costs by consolidating mailings.

This simple yet strategic adjustment can free up funds that would have otherwise been spent on separate mailings, allowing organizations to invest more in donor engagement.

2. Strengthen Donor Relationships

A tax receipt doesn’t have to be a mere transaction—it can be a touchpoint for gratitude and future giving. Including a personalized thank-you message with the receipt creates a lasting impression and reminds donors of their impact.

Ways to enhance donor engagement within tax receipt mailings:

- Personalized thank-you notes expressing appreciation.

- Updates on how donations have directly contributed to the cause.

- Invitations to upcoming events or exclusive donor opportunities.

When donors feel appreciated, they’re more likely to continue supporting the organization and become long-term advocates.

3. Increase Future Donations

When tax receipts are paired with a well-crafted thank-you letter, they can also serve as a subtle fundraising tool. Organizations can:

- Include a soft ask for future contributions.

- Provide QR codes or personalized URLs that link to an online donation page.

- Offer information on legacy giving, matching gifts, or volunteer opportunities.

Since tax receipts are typically expected and opened, they offer an excellent opportunity for re-engagement, ensuring that donors remain connected and invested in the organization’s mission.

4. Enhance Donor Experience & Sustainability

Beyond financial and relational benefits, consolidating tax receipts with thank-you notes aligns with sustainability goals by reducing paper waste and minimizing environmental impact.

- Fewer mailings mean less paper and lower carbon footprints.

- Encouraging donors to opt for digital receipts can further streamline operations and improve efficiency.

By making the donor experience seamless, impactful, and environmentally conscious, non-profits can build stronger, long-term relationships while promoting sustainable practices.

Small Changes, Big Impact

The simple act of combining tax receipts with thank-you messages is a strategic move that saves costs, enhances donor engagement, and fosters continued giving. Non-profits that embrace this approach can maximize their resources, build lasting donor relationships, and drive greater impact.

Is your organization looking to improve donor communications while saving on costs? Let’s discuss how to implement these best practices effectively!

[wpforms id=”1873″]